What is the Exchange Rate System in India?

Contents

What is the Exchange Rate System in India?

An exchange-rate regime is the way an authority manages its currency in relation to other currencies and the foreign exchange market. Between the two limits of fixed and freely floating exchange regimes, there can be several other types of regimes. In their operational objective, it is closely related to monetary policy of the country with both depending on common factors of influence and impact.

The exchange rate regime has a big impact on world trade and financial flows. The volume of such transactions and the speed at which they are growing makes the exchange rate regime a central piece of any national economic policy framework.

Types of Exchange Rate Region

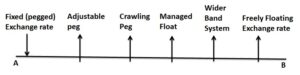

Fig. Types of Exchange Rate Region

In Fig., as one moves from point A on the left to point B on the right, both the frequency of intervention by domestic monetary authorities and required level of international reserves tend to be lower.

Under a pure fixed-exchange-rate regime (point A), authorities intervene so that the value of the domestic currency vis-a-vis the currency of another country, say the US Dollar, is maintained at a constant rate. Under a freely floating exchange-rate regime, authorities do not intervene in the market for foreign exchange and there is minimal need for international reserves.

Exchange Rate System in India

India was among the original members of the IMF when it started” functioning in 1946. As such, India was obliged to adopt the Bretton Woods system of exchange rate determination. This system is known as the par value system of pegged exchange rate system. Under this system, each member country of the IMF was required to define the value of its currency in terms of gold or the US dollar and maintain (or peg) the market value of its currency within + per cent of the defined (par) value.

The Bretton Woods system collapsed in 1971. Consequently, the rupee was pegged to pound sterling for four years after which it was initially linked to the basket of 14 currencies but later reduced to 5 currencies of India’s major trading partners.

This system continued through the 1980s; through the exchange rate was allowed to fluctuate in a wider margin and to depreciate modestly with a view to maintaining competitiveness. However, the need for adjusting exchange rate became precipitous in the face of external payments crisis of 1991.

As a part of the overall macro-economic stabilization programme, the exchange rate of the rupee was devalued in two stages by 18 per cent in terms of the US dollar in July 1991. With that, India entered into a new phase of exchange rate management.

Objectives of Exchange Rate Management

The main objectives of India’s exchange rate policy is to ensure that the economic fundamentals are truly reflected in the external value of the rupee.

(i) Reduce volatility in exchange rates, ensuring that the market correction of exchange rates is effected in an orderly and calibrated manner.

(ii) Help maintain an adequate level of foreign exchange reserves:

(iii) Prevent the emergence of destabilization by speculative activities; and

(iv) Help eliminate market constraints so as to assist development of a healthy foreign exchange market.

IMPORTANT LINK

- Institutions Providing Finance and Credit Facility for Foreign Trade

- What is Risk Analysis?

- Explain Political risks in detail? and its Types

- What are the types of Risks. Explain in detail?

- Meaning and Types of commercial risks

- How can we minimize foreign trade risks?

- What are Arbitrage operations?

- Difference between Spot Market and Forward Market

- What is spot exchange?

- Stability of Exchange Rate- Facts, significance, method, theories & warning

- Main Items Debit and Credit sides of the Balance of Payment

- Differences between Educational Administration and General Administration

- General Administration and Educational Administration

- Nature of Educational Administration

- Scope of School Administration

- Definitions of Educational Administration by Different Scholars

- Definitions of Educational Administration by Different Scholars

- Meaning of Educational Administration

- Principles of School Organisation and Administration

- Aims and Objectives of School Organisation

- School Organisation | Meaning of School Organisation | Meaning of School |Meaning of Organisation

Disclaimer