Contents

Previous Year and Assessment Year

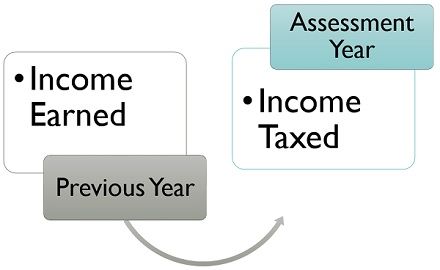

Previous Year and Assessment Year- The assesse is liable to pay tax on his income in the year immediately succeeding the year in which income was accrued. The Income tax Act prescribes uniform year to be followed by all assesses for tax purposes.

Previous Year (Sec. 3)

The previous year or the year of generation of income or financial year starts from 1st April of every year and ends on 31st March of next year.

In case of newly established business the first previous year starts from the date of setting up of business and ends on 31st March of next year.

Previous year is same for all incomes of assesse.

In respect of Hundies, year in which hundies are received or paid and in case of undisclosed income year in which the income arised will be previous year. If such year is not known, year in which such incomes comes to the knowledge of IT department will be the previous year.

In case of unexplained expenditure treated as income under Section 69 previous year will be the year in which such expenses were incurred.

Assessment Year [(Sec. 2(9)]

Assessment year is relative term and used to denote the year in which tax is payable for the previous year. Assessment year for a previous year starts from 1st April of year in which previous year ends and closing on 31st March of next year.

Examples: 1. ABC Ltd. was incorporated on 1 July, 2019. Its first previous year is 2019-20 (i.e. from 1 July, 2019 to 31 March, 2020) and assessment year for the previous year is 2020-21 (i.e. from 1st April, 2020 to 31 March, 2021).

2. Income earned an individual during, the previous year 2019-2020 is taxable in the assessment year 2020-21.

Tax Rates: Unless otherwise specified, tax rates and other provisions as on 1st April of assessment year are applicable. Tax rates are prescribed every year in Finance Act during budget session of Parliament.

| SL. No. | Previous Year | Assessment Year |

| 1. | Previous year is that year which is immediately preceding the assessment year. | Assessment year is previous year’s next year. |

| 2. | Previous year is the accounting year or in respect of which the income is assessed to tax. | Assessment year is the year in which the income of the previous year is assessed to tax. |

| 3. | The year in which income is earned, is called previous year. | The year in which income is assessed and taxed is called assessment year. |

| 4. | Duration of one year between 1st April to 31st March in which all financial information are reported is called previous year. | The income of a particular financial year is assessed in the following year, which is known as the assessment year. |

| 5. | 2020-21 is previous year for the income received or accrued during April 1, 2020 to March 4 31, 2021. | 2020-21 will be assessment for the income received or accrued in the immediately preceding previous year (i.e. April 1, 2019 to March 31, 2020). |

- Meaning and Types of commercial risks

- How can we minimize foreign trade risks?

- What are Arbitrage operations?

- Difference between Spot Market and Forward Market

- What is spot exchange?

- Agency agreement: Meaning, Features and Advantages

- Functions of Foreign Exchange markets

- structure of Foreign exchange markets

- Stability of Exchange Rate- Facts, significance, method, theories & warning

- Main Items Debit and Credit sides of the Balance of Payment

- Differences between Educational Administration and General Administration

- General Administration and Educational Administration

- Nature of Educational Administration

- Scope of School Administration

- Definitions of Educational Administration by Different Scholars

- Definitions of Educational Administration by Different Scholars

- Meaning of Educational Administration

- Principles of School Organisation and Administration

- Aims and Objectives of School Organisation

- School Organisation | Meaning of School Organisation | Meaning of School |Meaning of Organisation

Disclaimer